General Finance

Nov 14, 2024

•

5 min read

5 Min Rundown: The Role of Unstructured Data in Financial Services

Overview

In financial services, vast amounts of data are generated daily across wealth management, banking, insurance, and capital markets. While structured data such as transaction records, customer demographics, and financial metrics are organized and accessible, a significant portion of data is unstructured. This includes everything from financial reports, client communications, regulatory filings, and research reports, to social media, emails, and customer feedback. Much of this unstructured data remains untapped, despite its potential to improve decision-making and enhance operational efficiency.

Unstructured data is increasingly seen as a valuable asset in financial services, where automation and insights from data can drive growth, improve risk management, and enhance client services. By effectively utilizing unstructured data, financial institutions can streamline operations, optimize compliance, and deliver tailored customer experiences. However for most financial institutions, the challenge lies in figuring out how to effectively harness its potential.

The Role of Unstructured Data in Financial Services

In financial services, unstructured data comprises over 80% of the data generated, including documents like contracts, investment analyses, trade records, and customer interactions. This data holds critical insights but remains largely unused due to its complexity. Financial organizations have traditionally relied on structured data, as it’s easier to process and analyze. However, limiting automation to structured data overlooks valuable information in unstructured data that can enhance customer insights, risk assessment, and regulatory compliance. This also includes a company’s institutional knowledge that is generally left on the table or requires a manual process of having an employee or subject matter expert pass down the knowledge from one individual to the next.

1) Enhancing Investment Decision Support

Investment decisions often rely on diverse data sources, many of which are unstructured. Analysts sift through research reports, earnings calls, client communications, and news articles—all rich in qualitative insights but challenging to process at scale. By leveraging large language models, wealth management firms can analyze unstructured datasets to extract relevant insights, improving investment recommendations and portfolio management.

For instance, AI provides companies with the ability to identify sentiment and extract key financial metrics from company earnings reports and market news, which can be integrated into analysts’ decision-making processes. This allows financial professionals to uncover trends and opportunities more quickly, providing a competitive edge in a fast-paced industry.

2) Automating Compliance and Regulatory Reporting

The financial services industry faces stringent regulatory requirements, from Anti-Money Laundering (AML) and Know Your Customer (KYC) to data privacy and risk reporting. Much of the compliance-related information, including email communications, transaction records, and audit documents, is unstructured and requires extensive manual review.

By leveraging an AI platform that can process unstructured data, financial institutions can streamline compliance workflows, reduce manual labor, and improve accuracy. Take fraud detection, for example: AI can automatically flag unusual activities or suspicious language in customer interactions, supporting Anti-Money Laundering (AML) and fraud prevention efforts. It can also streamline regulatory reporting by organizing and structuring necessary information, ensuring timely, accurate submissions and reducing compliance risks.

3) Improving Customer Service and Personalization

As digital banking and personalized wealth management continues to gain popularity, customer expectations for tailored services are higher than ever. Unstructured data from customer feedback, support emails, social media, and service interactions provides a valuable source of insights into client preferences and concerns. Today, this is a manual process that requires a substantial amount of overhead to sift through and even more if you want to integrate it into your existing workflows.

With a proper AI platform, you can analyze this unstructured data to identify patterns and sentiments - helping financial institutions deliver personalized recommendations and proactive service. For example, businesses could use AI to detect dissatisfaction in customer messages and trigger automated outreach from a representative. This would drastically improve customer satisfaction and retention. By incorporating insights from unstructured data into customer profiles, financial services can deliver more personalized and responsive service, differentiating themselves in a competitive market.

4) Enhancing Risk Management and Fraud Detection

Unstructured data plays a critical role in identifying risks and preventing fraud in financial services. Regardless of what sector of financial services you’re in, data from transaction logs, email communications, trade documents, and external sources can help institutions detect patterns of fraudulent behavior or emerging risk factors.

With today’s advancement in technology, AI-powered tools can be used to analyze unstructured data for unusual patterns, keywords, or anomalies that may indicate fraud or high-risk transactions. For instance, algorithms can evaluate email content and external news reports to assess potential risks related to specific clients or investments. By automating the analysis of unstructured data, financial firms can proactively manage risks, reduce the incidence of fraud, and maintain more robust security measures. The real challenge however is finding a platform that can efficiently process unstructured data to automate complex workflows.

5) Streamlining Research and Financial Analysis

Investment firms, banks, and insurance companies rely heavily on research and analysis to make informed decisions. This involves sifting through large volumes of unstructured data, including financial reports, news, economic forecasts, and proprietary research.

With AI, financial analysts can automate the extraction and synthesis of information from unstructured data sources. For instance, AI tools can scan news and research reports for relevant insights, consolidating information that may impact investment strategies or product development. By streamlining research efforts, financial institutions can improve analysis efficiency, reduce time to insight, and drive better investment and business decisions.

6) Ensuring Data Security and Privacy Compliance

Financial services organizations are custodians of sensitive customer data and are required to adhere to strict privacy and security regulations, such as the General Data Protection Regulation (GDPR), SOC 2, and various national laws. This responsibility extends to unstructured data, such as emails, documents, and chat logs, which often contain PII.

AI platforms can help identify, classify, and secure unstructured data, ensuring compliance with data protection regulations. These tools can automatically detect sensitive information in unstructured datasets, enabling organizations to enforce data governance policies, manage data access, and secure client information. With robust data security and privacy measures, financial institutions can build trust with clients and regulatory bodies alike.

Unstructured data holds immense potential for financial services. By leveraging advanced AI and automation, firms can unlock insights that drive efficiency, enhance decision-making, and deliver personalized experiences in an increasingly data-driven landscape.

The Key to Unlocking Your Unstructured Data

I know what you’re thinking - easier said than done right? As unstructured data in financial services continues to expand, so does the potential to automate workflows and drive significant improvements in customer experience, compliance, and operational efficiency. As we discussed earlier, financial institutions rely on manual processes to interpret and utilize unstructured data, such as customer communications, regulatory documents, and financial reports. However, these processes are time-consuming and prone to errors due to the sheer volume and complexity of the data. To address this challenge, Gradient developed the first AI-powered Data Reasoning Platform, designed specifically to integrate structured and unstructured data. This innovative platform empowers financial organizations to build dynamic data workflows that go beyond the capabilities of traditional tools, unlocking new levels of efficiency and insight.

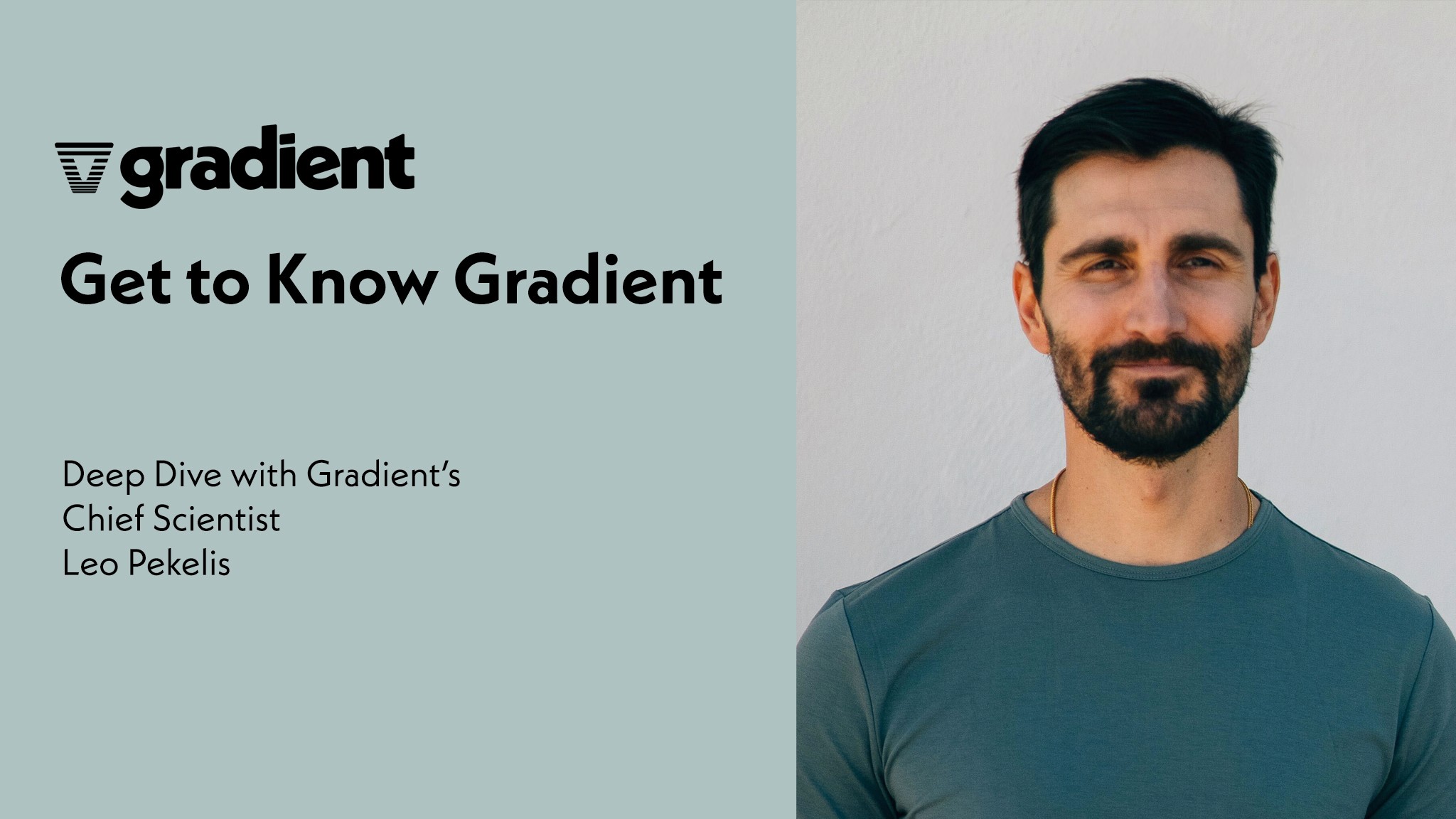

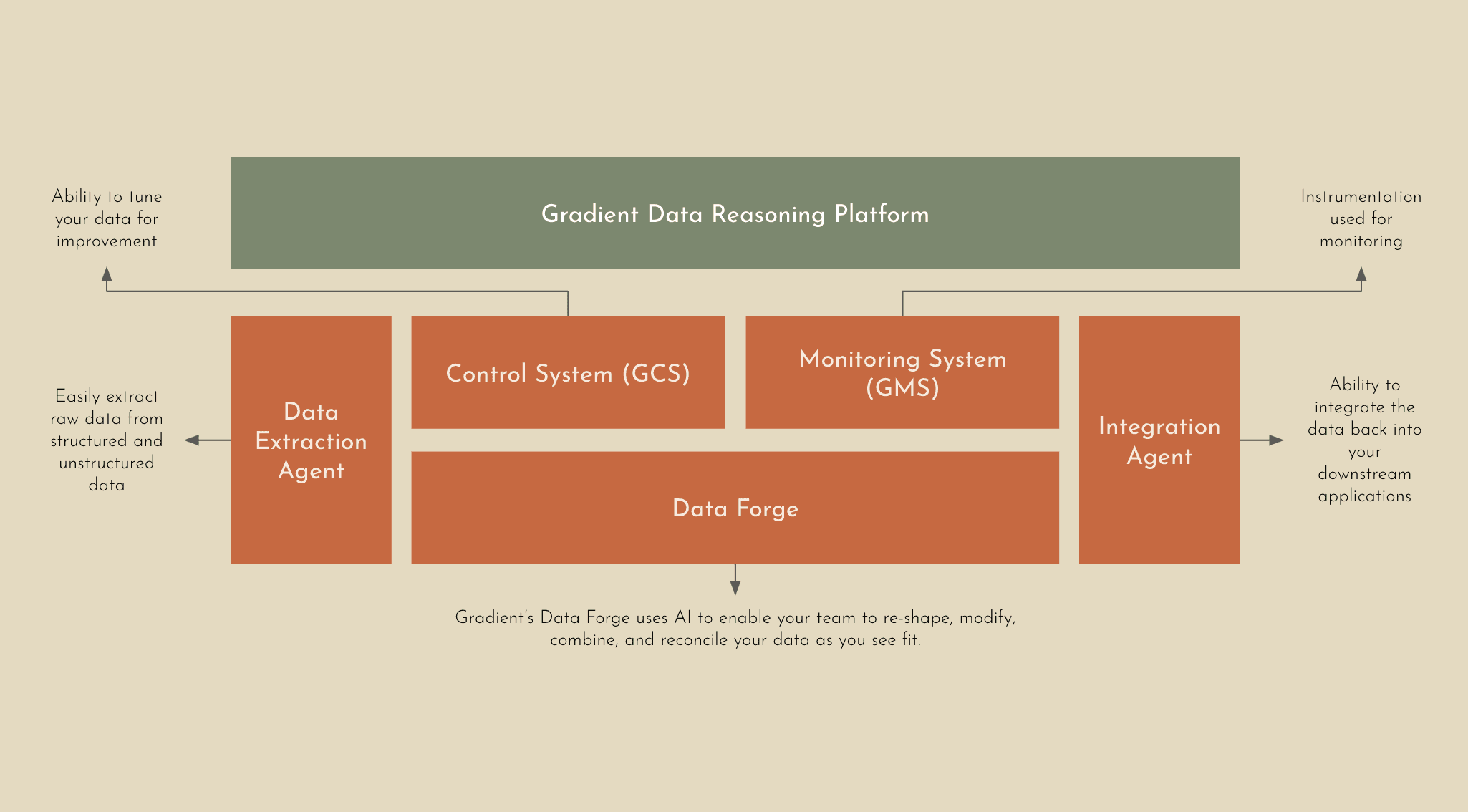

Gradient’s Data Reasoning Platform

Gradient’s Data Reasoning Platform is the first AI-powered and SOC 2 Type 2 compliant platform that’s designed to automate and transform how financial institutions and fintech companies handle their most complex data workflows. Powered by a suite of proprietary large language models (LLMs) and AI tools, Gradient eliminates the need for manual data preparation, intermediate processing steps, or a dedicated ML team to maximize the ROI from your data. Unlike traditional data processing tools, Gradient’s Data Reasoning Platform doesn’t require teams to create complex workflows from scratch and manually tune every aspect of the pipeline.

Schemaless Experience: The Gradient Platform provides a flexible approach to data by removing traditional constraints and the need for structured input data. Enterprise organizations can now leverage data in different shapes, formats, and variations without the need to prepare and standardize the data beforehand.

Deeper Insights, Less Overhead: Automating complex data workflows with higher order operations has never been easier. Gradient’s Data Reasoning Platform removes the need for dedicated ML teams, by leveraging AI to take in raw or unstructured data to intelligently infer relationships, derive new data, and handle knowledge-based operations with ease.

Continuous Learning and Accuracy: Gradient’s Platform implements a continuous learning process to improve accuracy that involves real-time human feedback through the Gradient Control System (GCS). Using GCS, enterprise businesses have the ability to provide direct feedback to help tune and align the AI system to expected outputs.

Reliability You Can Trust: Precision and reliability are fundamental for automation, especially when you’re dealing with complex data workflows. The Gradient Monitoring System (GMS) identifies anomalies that may occur to ensure workflows are consistent or corrected if needed.

Designed to Scale: Typically the more disparate data you have, the bigger the team you’ll need to process, interpret, and identify key insights that are needed to execute high level tasks. Gradient enables you to process 10x the data at 10x the speed without the need for a dedicated team or additional resourcing.

Even with limited, unstructured or incomplete datasets, the Gradient Data Reasoning Platform can intelligently infer relationships, generate derived data, and handle knowledge-based operations - making this a completely unique experience. This means that teams can automate even the most intricate workflows at the highest level of accuracy and speed - freeing up valuable time and overhead.

Under the Hood: What Makes it Possible

The magic of the Gradient Data Reasoning Platform is its high accuracy, quick time to value, and easy integration into existing enterprise systems.

Data Extraction Agent: Our Extraction Agent intelligently ingests and parses any type of data into Gradient without hassle, including raw and unstructured data. Whether you’re working with PDFs or PNGs we’ve got you covered.

Data Forge: This is the heart of the Gradient Platform. AI automatically reasons about your data - re-shaping, modifying, combining, and reconciling your structured and unstructured data via higher order operations to achieve your objective. Our Data Forge leverages advanced agentic AI techniques to guide the models through multi-hop reasoning reliably and accurately.

Integration Agent: When your data is ready, Gradient will ensure that your data can be easily integrated back into your downstream applications via a simple API.

With Gradient, businesses can focus on the outcomes—whether it’s driving customer insights, ensuring regulatory compliance, or optimizing production lines—without getting bogged down in the operational intricacies of data workflows. By automating complex data workflows, organizations can achieve faster, more accurate results at scale - reducing costs and enhancing operational efficiency. In a world where data complexity continues to grow, the ability to harness that data through automation is not just a competitive advantage—it’s a necessity. Take a look at some financial services use cases in detail that financial institutions and fintech companies are using Gradient for today.

Share