General Finance

Dec 30, 2024

•

5 min read

Agents and Data Reasoning: Overcoming the Limitations of RPA in Financial Services

Robotic Process Automation (RPA) has served as a cornerstone in the financial services industry for companies looking to streamline operations by automating repetitive, rule-based tasks. However, RPA’s limitations are becoming increasingly apparent as the automation needs of financial institutions continue to grow more complicated.

One study by Gartner shows that the RPA market is already showing signs of consolidation with vendors leveraging AI to fuel innovation and growth. To remain competitive, financial services companies must recognize RPA's limitations and adopt complementary solutions – like agents and data reasoning – that take automation beyond basic task execution.

Quick Primer on RPA

Robotic Process Automation (RPA) allows companies to automate manual, resource-intensive tasks and enjoy the associated efficiency gains and cost savings. RPA has been incredibly widespread for enterprise companies in the financial industry which accounted for 36% of all RPA use cases in 2023, according to an IBM blog citing a Forrester report.

Low-level manual tasks are prevalent across different verticals in the finance industry. For example, major banks often use RPA to automate tasks like:

Reconciling daily transactions between ATMs and the bank’s main ledger.

Generating and distributing customer account statements.

Automatically updating interest rates across savings and loan accounts

While RPA excels in automating rule-based tasks, it falls short when handling more complex workflows such as anti-money laundering or fraud detection. These more advanced tasks require applying logic and reasoning to the data, which we’ll get more into in a bit.

As the needs of modern financial services companies evolve, RPA’s limitations are becoming increasingly apparent. In order to stay competitive, enterprise companies must address the shortfalls of RPA and explore complementary solutions that are capable of handling higher-level operations.

This article will discuss the limitations of RPA, how agents and data reasoning can address these challenges, and the essential steps financial services companies need to take to harness this next wave of technology.

Where RPA Falls Short

While RPA excels at handling repetitive, rule-based tasks, most enterprise workflows are far more complex and involve multi-step processes – especially within the financial sector.

In a recent study by Gartner, the survey showed that while RPA can automate tasks, it often struggles with scalability across complex, enterprise-wide operations, leading to increased maintenance and integration challenges. Roughly 48% of RPA projects fail due to excessive complexity, while 30% tend to fail due to the lack of context that’s required to conduct the task.

It’s safe to say that the success rate of automation drops significantly as complexity rises, with successful implementations becoming the exception rather than the norm. So what exactly are the shortcomings when it comes to RPA?

Performance - Rule-Based Tasks: RPA is designed for structured, repetitive processes and cannot handle tasks requiring judgment or decision-making.

Performance - Prone to Errors: RPA automates flawed processes without identifying or correcting errors, potentially amplifying inaccuracies. This makes RPA especially troublesome in the financial industry, which is held to strict compliance and reporting standards.

Performance - Inability to Process Unstructured Data: RPA tends to struggle with data formats like emails, PDFs, images, or free-form text, limiting its application scope. Again, this is a major issue for large financial institutions that often receive unstructured data inputs in the form of client communications, images, or videos.

Performance - Lacks Contextual Understanding: RPA performs tasks without understanding their broader context, which limits its ability to prioritize or reason. For example, an investment manager could use RPA to automatically execute trades in the stock, bond, or commodities markets. But, while the bot can execute these trades seamlessly, it cannot factor in new market conditions and adjust its strategy accordingly in real time which is one of the most critical pieces for this process.

Scalability - Lack of Adaptability and Requires Maintenance: RPA bots require reprogramming for any changes in workflows, making them rigid in dynamic environments. This means that updates and monitoring are constantly required to keep workflows functioning properly, which increases overhead.

RPA Example: Falling Short in Insurance

Insurance agencies can use RPA to automate simple insurance claims by extracting the claim details (policyholder’s information, incident description, etc.) and then comparing it against the policy’s coverage to determine whether or not the policyholder is covered. But, while RPA can handle simple claims, it quickly falls short when the claims start to get more ambiguous.

For example, let’s consider an automotive insurance claim. RPA can collect accident details like police reports and witness statements from a car accident and then match them to policy conditions. However, it cannot determine liability in cases with conflicting or unclear reports of what happened.

Additionally, in the case of a property damage claim, RPA can extract data from a damage assessment and calculate preliminary payouts based on policy terms. But, it cannot determine how to apportion liability if the damage includes a mix of covered (pipe bursting) and non-covered events (flooding) events.

The Emergence of Intelligent Agents and Data Reasoning

In recent years, the term "AI agents" has become just as prominent as "AI" itself. For those unfamiliar, an AI agent is a software program designed to perform tasks autonomously on behalf of a user, with intelligence that mimics human-like behavior. These agents can analyze data, make decisions, and learn from their interactions and experiences, enabling them to improve and adapt their performance over time. With agents, enterprise financial companies can overcome RPA’s shortfalls including:

Performance - Rule-Based Tasks: Agents can handle complex, multi-step tasks that require decision-making, reasoning, and context awareness. They excel in workflows that involve dynamic inputs or require real-time adjustments, which makes them perfect for many finance-specific processes like compliance & fraud prevention, market intelligence, or personalization capabilities for enhancing customer interactions.

Performance - Prone to Errors: Agents can continuously learn and improve performance throughout the process - adapting autonomously to match evolving workflows and environments in the finance sector.

Performance - Inability to Process Unstructured Data: Agents leverage LLMs (large language models) that can help analyze both structured and unstructured data. Whereas RPA may have challenges breaking down unstructured data, agents can leverage a variety of techniques to process the data.

Performance - Lacks Contextual Understanding: An AI agent understands context and relationships, enabling smarter decisions and task prioritization.

Scalability - Lack of Adaptability and Requires Maintenance: Agents require less maintenance since they adapt autonomously to changes within the systems or within the process.

Scalability - Ineffectiveness with Complex Processes: Agents manage complex, multi-step workflows by using their dynamic decision-making capabilities.

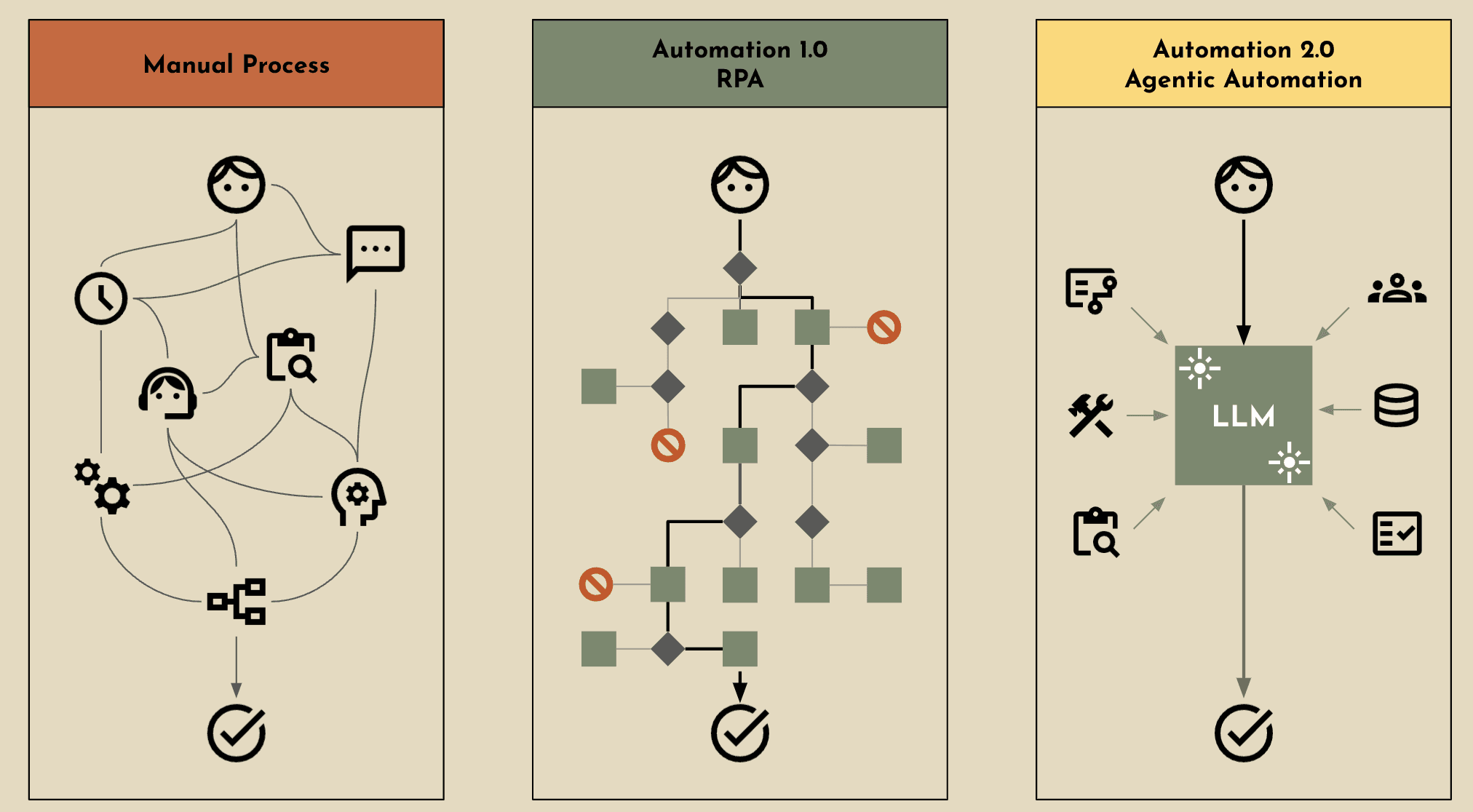

With these unique capabilities, AI agents introduce a new era of automation, performing tasks intelligently and autonomously without human intervention—a concept we call agentic automation or automation 2.0.

AI Agents in Finance

The financial sector is set to benefit drastically from AI agents due to their higher-level reasoning capabilities. According to the World Economic Forum, AI agents will benefit the finance sector in four key ways:

Customer Interaction: AI agents will be able to provide a higher level of customer interaction which involves improving client engagement, relationship management, and financial advisory.

Product & Pricing: There are dozens of ways that AI agents could improve financial products, including creating more customized product offerings that are tailored to customers’ interests based on different data sets.

Compliance & Fraud Prevention: AI agents can help streamline common workflows like transaction monitoring, financial risk surveillance, software compliance testing, and process automation.

Market Intelligence: AI agents can provide their organizations with enhanced market intelligence by monitoring competitor strategies and overall market shifts.

Enterprise organizations that are early adopters of AI agents will undoubtedly enjoy an advantage over competitors in the marketplace. However, agents are just one part of the equation when it comes to automation. The true power lies in the data itself and how it’s utilized to create meaningful outcomes. In other words, it’s about the logic applied to the data—what we call data reasoning.

What is Data Reasoning is it the Answer for the Financial Service’s Industry?

Data reasoning is the practice of analyzing, interpreting, and applying logic to data, in order to draw insights that can help deliver informed decision-making. It goes beyond basic data collection and analysis that’s associated with RPA by focusing on understanding the why behind the what. At Gradient, we like to describe this as moving from basic operational tasks to higher-order operational tasks.

Unlike basic operational tasks—which might handle simple calculations or aggregations—data reasoning takes it a step further, using advanced operations to interpret data and help you integrate your institutional knowledge back into your workflows. This can involve uncovering relationships between data points, forecasting future trends, analyzing sentiment, or integrating unstructured data from various sources to produce actionable insights.

In essence, data reasoning requires more than just access to data; it requires the ability to process, interpret, and derive meaning from data in ways that align with specific business goals. And by data, we mean all types—both structured and unstructured. This process is especially valuable in financial use cases where data alone cannot yield straightforward answers but requires deeper analysis and contextual understanding to guide decisions.

If you’re interested in seeing whether or not data reasoning is right for your organization, you can find out by answering these 5 questions here. Or if you’re interested in learning a bit more about the various levels of complexity when it comes to data reasoning, you can check out our breakdown here.

So Are Agents and Data Reasoning the Answer?

In short, yes—but with some important factors to consider especially if you’re using traditional methods and techniques. While agents and data reasoning represent a significant advancement in automation, financial institutions should consider the following: Deploying agents into production can be complex, and overcoming these hurdles is essential to unlocking their full potential.

The primary challenges with implementing AI agents lie in the need for technical expertise, ensuring data accessibility, and managing the inherent complexities of applying logic to data effectively.

Challenges Implementing AI Agents

1. Technical Depth and Resourcing

Working with AI agents demands a significant level of technical expertise, often requiring a multidisciplinary team that includes machine learning engineers, data scientists, software developers, and domain specialists.

Building, training, and maintaining AI agents is a far cry from deploying rule-based systems like RPA. For instance, creating an agent capable of real-time risk mitigation or personalized customer interactions requires expertise in natural language processing, predictive modeling, and domain-specific knowledge in finance to integrate everything together. While doable, not every enterprise company will have the resources to make it happen.

In short, adopting initiatives like these often requires a significant upfront investment, particularly for organizations starting from scratch. Without the necessary technical expertise, many companies struggle to implement production-ready AI solutions, turning these opportunities into aspirational goals rather than practical realities.

2. The Data Dilemma: Accessibility and Structure

Despite advancements in AI, significant challenges remain around data—particularly in processing, accessing, and preparing unstructured information.

An estimated 80% of enterprise data in the finance industry is unstructured which includes documents like contracts, investment analyses, trade records, and customer interactions. These data sources hold valuable insights but often go unused due to the complexity of reformatting the data. The finance industry is also rife with obstacles like siloed systems, legacy databases, and inconsistent data formats – all factors that make it difficult to extract the clean, cohesive datasets AI agents require to perform effectively.

For example, while an AI agent might be capable of analyzing customer sentiment from emails and social media posts, extracting this data from disparate sources and ensuring it’s properly formatted for analysis is a labor-intensive process. This complexity is exacerbated in industries like financial services, where sensitive data must also meet strict compliance standards, adding another layer of difficulty to data accessibility.

3. The Complexity of Data Reasoning

Even with a fully staffed technical team and access to well-prepared data, applying reasoning and logic to that data is complicated. The challenge with data reasoning is that it’s inherently complex. Real-world data is not ideal. As we mentioned earlier, it can be noisy, incomplete, unstructured, or inconsistent - posing significant challenges to teams that have to work with this data. On top of that, distinguishing between correlation and causation requires deep expertise and careful methodology. This means that you’ll need a unique blend of analytical prowess, domain knowledge, and critical thinking if this is something you want to pursue. Unlike static algorithms, AI agents are expected to operate in dynamic environments where decisions must account for uncertainty and constantly evolving data.

For instance, in asset management, an AI agent tasked with portfolio optimization must weigh multiple variables—market trends, risk profiles, and investor preferences—while adapting to real-time changes. This level of reasoning requires not only advanced algorithms but also an understanding of the domain, as applying logic without context can lead to inaccurate or suboptimal decisions.

Simplify Data Reasoning with Gradient

So, is there an easier way to deal with the challenges present when implementing an AI agent? That answer is yes.

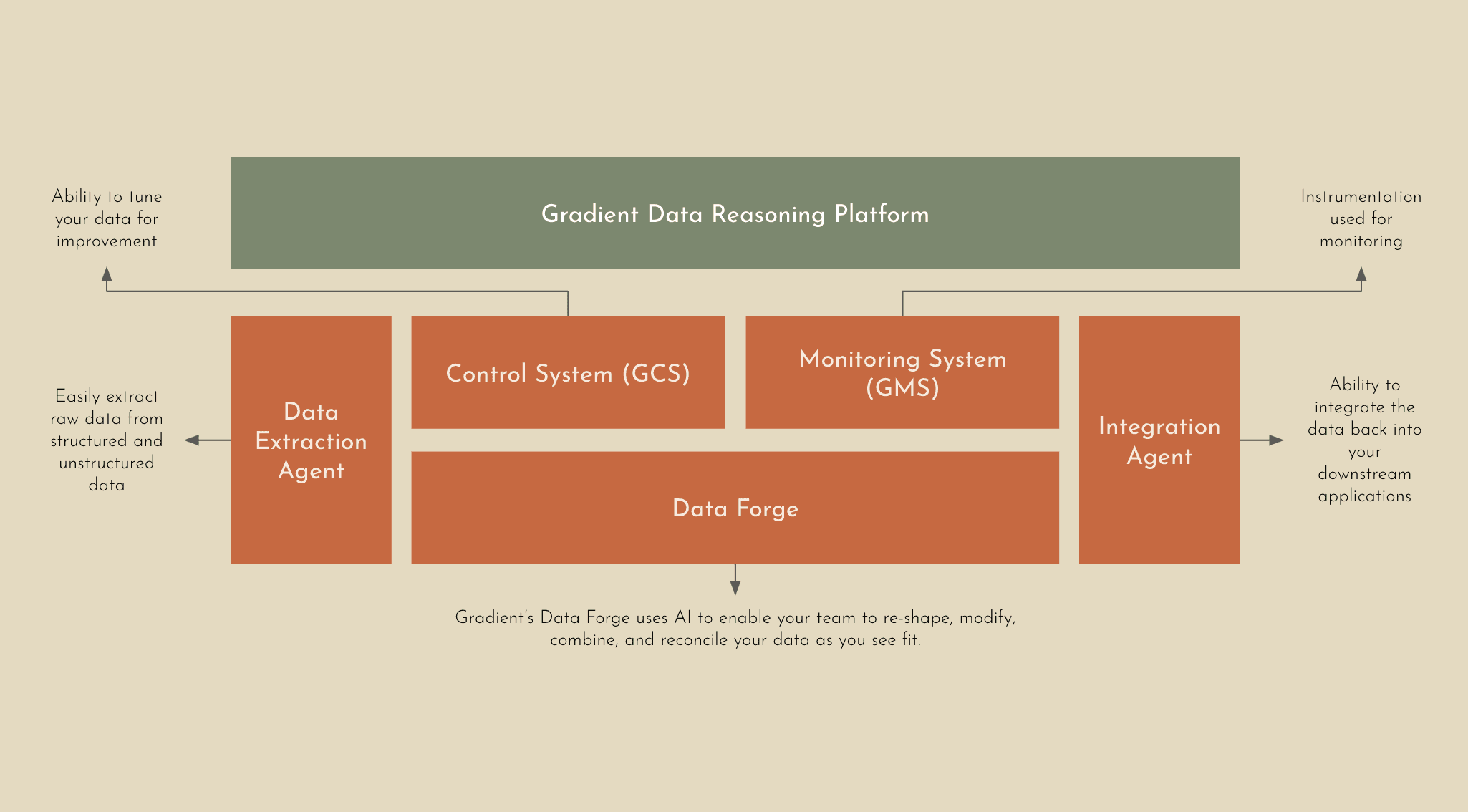

The team at Gradient has developed the first AI-powered Finance Reasoning Platform that’s designed to automate and transform how financial companies handle their most complex data workflows. Powered by a suite of proprietary large language models (LLMs) and AI tools, Gradient eliminates the need for manual data preparation, intermediate processing steps, or a dedicated ML team to maximize the ROI from your data.

Unlike traditional data processing tools, Gradient’s Finance Reasoning Platform doesn’t require teams to create complex workflows from scratch and manually tune every aspect of the pipeline.

Schemaless Experience: The Gradient Platform provides a flexible approach to data by removing traditional constraints and the need for structured input data. Enterprise financial organizations can now leverage data in different shapes, formats, and variations without the need to prepare and standardize the data beforehand.

Deeper Insights, Less Overhead: Automating complex data workflows with higher-order operations has never been easier. Gradient’s Data Reasoning Platform removes the need for dedicated ML teams, by leveraging AI to take in raw or unstructured data to intelligently infer relationships, derive new data, and handle knowledge-based operations with ease.

Continuous Learning and Accuracy: Gradient’s Platform implements a continuous learning process to improve accuracy that involves real-time human feedback through the Gradient Control System (GCS). Using GCS, enterprise businesses have the ability to provide direct feedback to help tune and align the AI system to expected outputs.

Reliability You Can Trust: Precision and reliability are fundamental for automation, especially when you’re dealing with complex data workflows. The Gradient Monitoring System (GMS) identifies anomalies that may occur to ensure workflows are consistent or corrected if needed.

Designed to Scale: Typically the more disparate data you have, the bigger the team you’ll need to process, interpret, and identify key insights that are needed to execute high-level tasks. Gradient enables you to process 10x the data at 10x the speed without the need for a dedicated team or additional resourcing.

Even with limited, unstructured, or incomplete datasets, the Gradient Finance Reasoning Platform can intelligently infer relationships, generate derived data, and handle knowledge-based operations - making this a completely unique experience. This means that teams can automate even the most intricate workflows at the highest level of accuracy and speed - freeing up valuable time and overhead.

Under the Hood: What Makes it Possible

The magic of the Gradient Finance Reasoning Platform is its high accuracy, quick time to value, and easy integration into existing enterprise systems.

Data Extraction Agent: Our Extraction Agent intelligently ingests and parses any type of data into Gradient without hassle, including raw and unstructured data. Whether you’re working with PDFs or PNGs we’ve got you covered.

Data Forge: This is the heart of the Gradient Platform. AI automatically reasons about your data - re-shaping, modifying, combining, and reconciling your structured and unstructured data via higher-order operations to achieve your objective. Our Data Forge leverages advanced agentic AI techniques to guide the models through multi-hop reasoning reliably and accurately - contextualizing the institutional data and grounding it to elicit the best output.

Integration Agent: When your data is ready, Gradient will ensure that your data can be easily integrated back into your downstream applications via a simple API.

With Gradient, finance companies can focus on the outcomes—whether it’s driving customer insights, ensuring regulatory compliance, or capturing market intelligence—without getting bogged down in the operational intricacies of data workflows. By automating complex data workflows, organizations can achieve faster, more accurate results at scale - reducing costs and enhancing operational efficiency. In a world where data complexity continues to grow, the ability to harness that data through automation is not just a competitive advantage—it’s a necessity.

Final Thoughts: Data Reasoning in Financial Services

For years, financial services companies have viewed Robotic Process Automation as a key technology needed for automation. However, it’s becoming clear that RPA cannot handle tasks requiring the higher-level decision-making necessary to succeed in today’s fast-paced world. To overcome this, the finance sector is transitioning to AI agents and data reasoning.

AI agents are capable of performing tasks autonomously in a way that mimics human-like intelligence. This includes analyzing unstructured data, making decisions, and learning from their interactions and experiences over time. Implementing these agents is a complicated process that often involves extensive expertise and resources to operate.

This is why we created Gradient’s AI-powered Data Reasoning Platform. Powered by proprietary technology, Gradient allows you to harness the power of artificial intelligence for just a fraction of the cost. Interested in learning how a high-performing, cost-effective custom AI system could benefit your business? Contact the Gradient team today to learn more.

We hope that you’ve found this article valuable when it comes to learning more about how AI agents and data reasoning are helping financial services companies overcome the limitations of RPA.

Share