Asset Management

Aug 21, 2024

•

5 min read

AI-Powered Data Transformation for Portfolio Management

Overview

In order to maximize your investments, it’s important for asset managers to have a heuristic view on how the companies within their portfolio are performing. A prominent US-based investment firm, managing hundreds of portfolio companies, faced significant challenges with processing and analyzing unstructured data submitted by their portfolio companies. The aggregated data is essential for the firm's internal portfolio management application and helps team’s monitor, analyze, and optimize the performance of their investments based on benchmarks derived from the results. However data that is submitted is often inconsistent and requires labor-intensive manual intervention. Partnering with Gradient, the firm leveraged Gradient’s AI data platform for intelligent data extraction and transformation, in order to automate the process for maximum efficiency and accuracy.

The Challenge

The investment firm encountered several challenges in managing the data that was provided by their portfolio companies.

Varied, Inconsistent Data: The type of data that is submitted by the portfolio companies are often unstructured and vary in format, including qualitative insights from executive meetings, sales collateral, financial statements, and quarterly reports. While the data is rich in context, it makes it challenging to efficiently analyze since it lacks standardization and organization.

Time-Consuming and Manual Process: In order to interpret this data, the firm spent a significant amount of resources and time to help provide structure and organization. From generating necessary calculations in order to provide consistent financial inputs to converting data into the right format, the process is not only manually taxing but labor-intensive.

High Probability of Errors: Due to the manual nature of the data processing, there was a significant risk of errors in calculations and data interpretation, which could potentially lead to incorrect insights and decisions.

The AI-Driven Solution

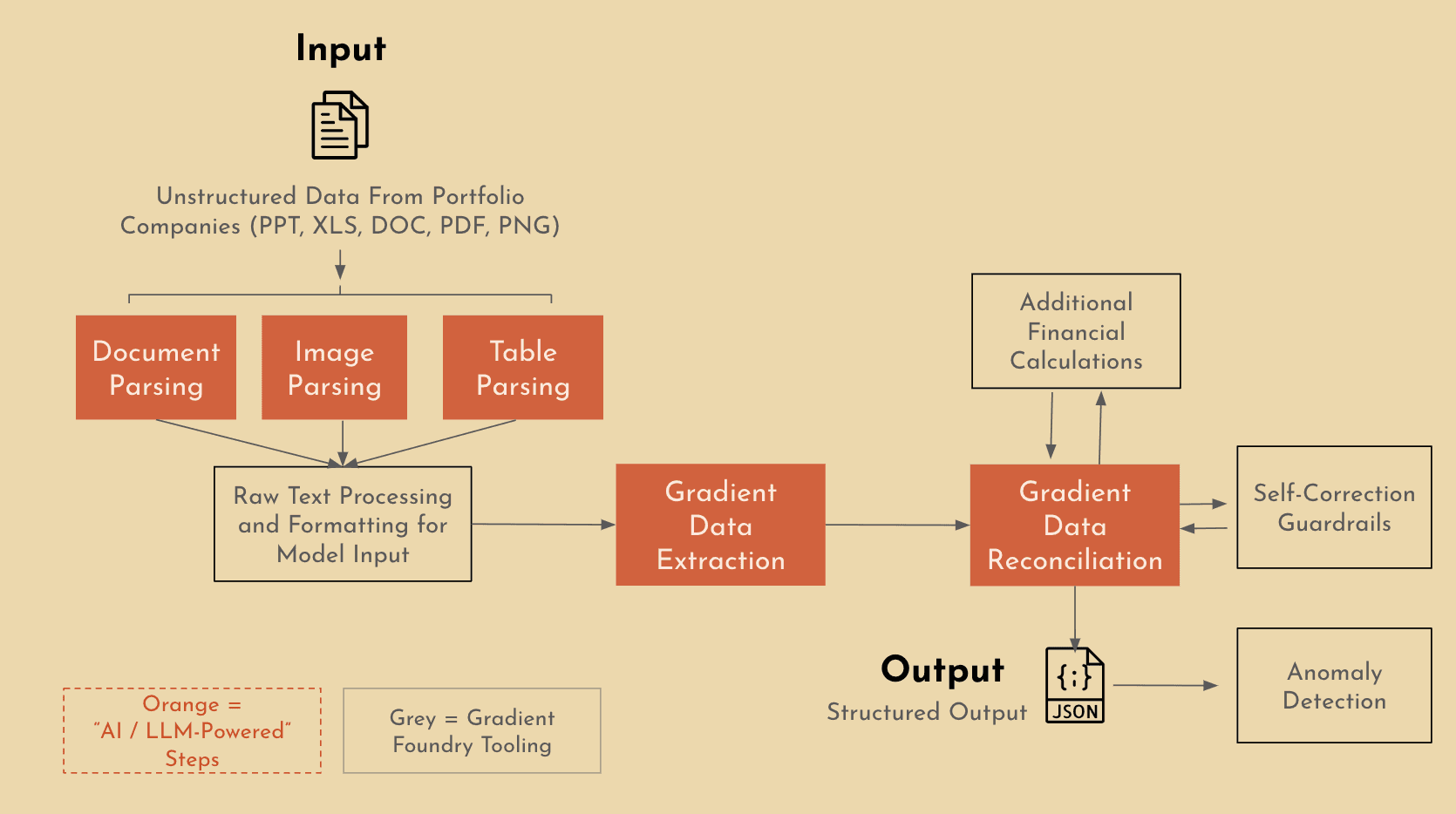

To address these challenges, the investment firm implemented Gradient’s AI data platform to automate and enhance their data management process. By intelligently extracting the incoming raw data and transforming it into rich structured text, the team was able to effectively use it to power downstream applications.

AI-Powered Data Extraction

Gradient’s AI system was deployed to automate the extraction and structuring of raw data stored within the firm’s content management system (e.g. Dropbox). The AI identified key entities, relationships, and themes within the unstructured data, transforming it into a structured format that could be seamlessly integrated into the firm’s portfolio management application.

Automated Calculations

Once the raw data was structured, our AI systems automated the necessary financial calculations. This automation filled in missing context or gaps in the data, creating consistent benchmarks and projections that were vital for the firm’s investment analysis and decision-making processes.

The Impact

The implementation of Gradient’s AI data platform had a profound impact on the firm’s operations:

Increased Accuracy: Automating the data extraction and calculation processes led to a 30% increase in end-to-end accuracy, significantly reducing errors that were previously caused by manual data handling.

Reduction in Workload: The automation drastically reduced the manual effort required, freeing up resources for more strategic tasks. The overall workload was reduced by approximately 80%, allowing the firm to reallocate their team’s focus to higher-value activities.

Cost Savings: By eliminating one of the most labor-intensive tasks in their operations, the firm achieved a 30% reduction in overall costs. This cost-savi

Conclusion

By partnering with Gradient and leveraging advanced AI technology, the investment firm was able to transform its data management process, leading to improved accuracy, reduced workload, and significant cost savings. This highlights the potential for AI to drive operational efficiencies, while firms can focus on strategic decision-making and optimization of their investment portfolios.

Share