General Finance

Jan 8, 2025

•

5 min read

Unstructured Data: The Most Valuable Resource You Didn’t Know You Had

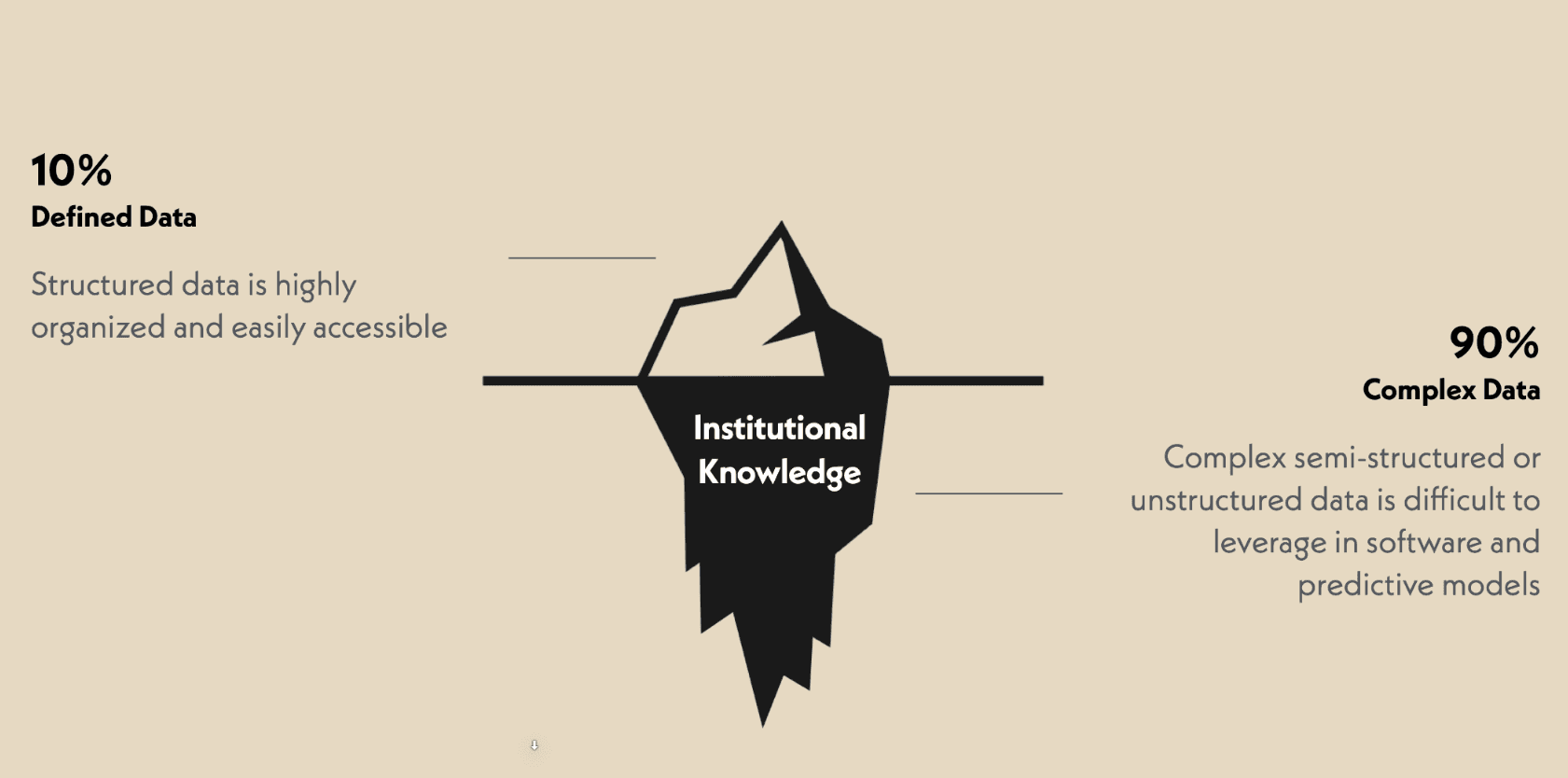

You can only see 10% of an iceberg at any given time as approximately 90% of the average iceberg’s mass is underwater. Similarly, most financial services companies only leverage a small percentage of their available data while the vast majority goes unused. This is because roughly 80-90% of the world’s data is unstructured, according to an estimate from MIT’s Sloan School of Management.

Historically, unstructured data has been nearly impossible for companies to utilize unless it was properly cleaned and formatted to be compatible with modern analytical tools. Not only is this an expensive and time-consuming process but it’s also incredibly difficult to clean large datasets without altering them and damaging their quality.

However, using new artificial intelligence (AI) solutions like Gradient’s Finance Reasoning Platform, it’s now possible for modern finance companies to tap into unstructured data sources to streamline operations, open up new revenue opportunities, and gain unique insights.

This article will take a closer look at why unstructured data is the most valuable resource you didn’t know you had and how Gradient can help you leverage it to your advantage.

The Era of Big Data

Data is one of the most valuable resources that a company can have in today’s economy. Modern corporations harness both internal and external data sources to help improve decision-making, learn more about their customers, gain a competitive advantage in the marketplace, streamline operations, and drive profitability. Experts consider the field of data analytics to be especially important in finance, which is one of the most data-heavy industries in the world.

What sets the financial services industry apart from so many others is the abundance of both internal and external data sources. Finance companies can collect an almost mind-numbing stream of data from their own customers. But, depending on the industry, they can also leverage a number of exterior data sources including:

Market Data: Stock prices, bond yields, commodities, exchange rates, indexes

Macroeconomic Data: GDP, unemployment rates, inflation rates, consumer confidence reports

Central Bank Policies: Inflation rate decisions, FOMC minutes, economic forecasts

Real Estate Data: Property values, rental market trends, zoning laws

Credit and Risk Data: Credit scores, default rates

Consumer Behavior Data: Spending patterns, consumer sentiment reports

Industry-Specific Data: Sector trends, M&As, supply chain data

These are just a few of the external data sources that asset managers, banks, and other financial institutions may be interested in monitoring, in addition to their own internal data flows and customer data. However, there is just one major problem…the overwhelming majority of these datasets are unstructured.

What is Unstructured Data?

Unstructured data is any form of data that is not recorded in a uniform format using traditional methods.

For example, a bank likely keeps detailed records of transactions, customer demographics, and financial metrics. All of these datasets would be considered “structured” because they have a predefined schema, are uniformly organized, and are recorded properly. But, the bank also has access to large datasets that are not uniformly organized such as financial reports, client communications, regulatory filings, social media posts, or any institutional knowledge that is passed down over the years. All of these datasets would be considered “unstructured” because they lack a predefined schema and uniformity.

Unstructured data can come in any form including text, imaging, audio, and sensor data. Some of the most common forms of unstructured data in the asset management, banking, and insurance industries include:

Financial Reports

Client Communications

Regulatory Filings

Research Reports

Social Media

Emails

Customer Feedback

These types of data make up an overwhelming 80-90% of the world’s data according to MIT. Due to its prevalence, unstructured data also represents a massive opportunity for companies – which is why we say that unstructured data is the most valuable resource you didn’t know you had. Experts at MIT expressed that:

“Data locked away in text, audio, social media, and other unstructured sources can be a competitive advantage for firms that figure out how to use it.”

Let’s examine the potential of unstructured data in a bit more detail.

The Potential of Unstructured Data

Unstructured data holds insights into how companies can better please their customers, streamline operations, improve productivity, boost profitability, and much more. Here are a few common examples of how unstructured data can be leveraged:

Removing Bottlenecks in Your Data Extraction Process: By using AI-powered tools like Gradient’s Finance Reasoning Platform, companies no longer need to allocate resources and manpower toward the time-intensive process of untangling unstructured data to extract value. With Gradient, you can take structured or unstructured data and apply reasoning to it to unlock value - enabling higher-quality insights, quicker turnaround times, and the ability for your team to focus on more strategic, higher-level tasks.

Uncovering Customer Insights: Unstructured data sources like PDFs, customer support, public reviews, and social media posts hold a treasure trove of information about how your customers feel. If you can monitor and identify repetitive comments or complaints then you can change your company policies to try and eliminate those complaints altogether.

Improving Investment Performance: Time is money in the financial world and the companies that can leverage public information most efficiently put themselves in a position to outperform their competitors.

Offering Targeted Products: Unstructured customer data sources can help reveal more information about their lives and fuel predictive models to anticipate products that might be most relevant.

However, there’s just one major problem with unstructured data. Because it lacks a simple structure, most AI and data analytics solutions have trouble parsing and interpreting the data. With that in mind, let’s explore why most companies have been unable to leverage unstructured data to their advantage.

The Problem with Unstructured Data

Unstructured data has traditionally been a roadblock preventing financial services companies from drilling into their data. Unstructured data creates four main challenges for companies looking to interpret it:

Data Integration and Fragmentation: Not only is the majority of data in the financial services industry unstructured but it is also commonly siloed across an organization, making it difficult to create a unified view.

Data Privacy and Compliance: Unstructured data in financial services often contains sensitive information such as personal identifiers, transaction details, and customer communication logs. This makes data privacy and compliance a significant challenge, especially in an industry heavily regulated by standards like GDPR, FINRA, and the SEC.

Data Quality and Noise: Unstructured data often lacks consistency and quality, which complicates efforts to derive actionable insights. Many forms of unstructured data also include irrelevant bits of data, known as “noise”, that usually need to be filtered out in order to maintain quality and reliability. If the data isn’t cleaned then it can negatively impact the accuracy and effectiveness of decision-making processes.

Resource Intensive Processing: Extracting insights from unstructured data requires time, money, and resources usually in the form of advanced artificial intelligence, machine learning, and natural language processing. Prior to solutions like Gradient, financial institutions often had to hire in-house data scientists to oversee the process.

For most AI tools to work properly, unstructured data traditionally had to be cleaned and reformatted so that it was in a form that AI could understand. The process of cleaning and reformatting the data was an immense undertaking in and of itself that required extensive time, money, and effort to do properly. Only companies with millions of dollars in their budget to spare had the resources to onboard artificial intelligence solutions. But, this isn’t the case anymore.

Unstructured Data Has Prohibited Progress…Until Now

Solutions like Gradient’s Finance Reasoning Platform are capable of leveraging unstructured data in its raw form so that financial services companies can leverage the power of AI in a cost-effective way. Gradient’s Finance Reasoning Platform works by using a process known as data reasoning.

Data reasoning is the practice of analyzing, interpreting, and applying logic to data, in order to draw insights that can help deliver informed decision-making. It goes beyond basic data collection and analysis that’s associated with RPA by focusing on understanding the why behind the what. At Gradient, we like to describe this as moving from basic operational tasks to higher-order operational tasks. If you’re interested in learning more about how Gradient’s solution works then be sure to read our article Data Reasoning 101: Understanding the Various Levels of Complexity.

How Can Gradient’s Finance Reasoning Platform Help You?

Gradient’s Finance Reasoning Platform has been custom-built for the financial sector and helps provide value in five key ways:

Deeper Insights, Less Overhead: Gradient can help automate complex data workflows, by leveraging AI to take in raw or unstructured data to intelligently infer relationships, derive new data, and handle knowledge-based operations with ease. Our platform removes the need for a dedicated team of data scientists, helping you leverage the power of AI with less overhead.

Continuous Learning and Accuracy: Gradient’s Platform implements a continuous learning process to improve accuracy that involves real-time human feedback through the Gradient Control System (GCS). Using GCS, enterprise businesses have the ability to provide direct feedback to help tune and align the AI system to expected outputs.

Reliability You Can Trust: Precision and reliability are fundamental for automation, especially when you’re dealing with complex data workflows. The Gradient Monitoring System (GMS) identifies anomalies that may occur to ensure workflows are consistent or corrected if needed. This reliability also allows us to achieve compliance with all major regulatory requirements including SOC 1, SOC 2, GDPR, and more.

Designed to Scale: Typically the more disparate data you have, the bigger the team you’ll need to process, interpret, and identify key insights that are needed to execute high-level tasks. Gradient enables you to process 10x the data at 10x the speed without the need for a dedicated team or additional resourcing.

Schemaless Experience: The Gradient Platform provides a flexible approach to data by removing traditional constraints and the need for structured input data. Enterprise financial organizations can now leverage data in different shapes, formats, and variations without the need to prepare and standardize the data beforehand.

Data Reasoning in Action

Financial institutions are already leveraging Gradient’s Finance Reasoning Platform to gain key insights and operate more efficiently. Here are just a few ways that financial institutions are using Gradient’s AI solution:

Anti-Money Laundering: A large US bank, serving approximately 40,000 corporate and institutional clients, uses Gradient to reduce transaction risk and increase the accuracy of detecting suspicious activity.

Trade Settlement: A prominent asset manager uses Gradient to automate and enhance their trade settlement process, leading to significant operational improvements and cost savings.

Investment Analysis: A US-based asset management fund with an AUM of $40 billion uses Gradient to improve its investment performance by streamlining the process it uses to analyze data so that its team can make faster, better investment decisions.

Final Thoughts: Unstructured Data and Data Reasoning

The financial services industry is adopting artificial intelligence at an incredibly rapid pace. A 2022 study sponsored by Ernst & Young showed that 85% of financial institutions already used some form of AI, triggered by the need for increased speed and efficiency and the opportunity for deeper data-driven insights.

Over the coming years, artificial intelligence will introduce a technological upheaval similar to the invention of the smartphone or the internet. Companies that move quickly to adopt this new technology will gain a unique advantage over their competitors. One of the most glaring use cases for AI is to dissect unstructured data sets in order to gain key insights.

By digging into both internal and external unstructured data sources financial services companies can identify and remove potential roadblocks, learn more about their customers, and adapt to market changes quickly. Historically, it has been incredibly difficult and resource-intensive for companies to leverage unstructured data sources due to their complexity and inconsistency, which made them incompatible with artificial intelligence solutions. But, this isn’t the case today.

Solutions like Gradient’s Finance Reasoning Platform are custom-made to help financial institutions gain insights from their unstructured data sources, automate higher-order operational workflows, and improve productivity. Interested in learning how a high-performing, cost-effective custom AI system could benefit your business? Contact the Gradient team today to learn more.

We hope that you’ve found this article valuable when it comes to learning why unstructured data is the most valuable resource that you didn’t know you had.

FAQ: AI Systems, Automation, and Data Reasoning

What is Data Reasoning?

Data reasoning is an emerging field of artificial intelligence that involves analyzing, interpreting, and applying logic to data, in order to draw insights that can help deliver informed decision-making. Data reasoning has widespread use cases in the financial sector, mainly helping companies automate higher-order operational tasks.

How Can AI Systems Help With Automation?

Artificial intelligence solutions like Gradient’s Finance Reasoning Platform are capable of helping companies automate higher-order operational tasks, even when dealing with unstructured data sources.

What is Unstructured Data in Artificial Intelligence?

Unstructured data is any form of data that is not stored in a traditional database format. It represents anywhere from 80-90% of the world’s data, according to MIT’s Sloan School of Management. Over the coming years, AI will play a key role in helping companies gain key insights from unstructured data sources.

Share