General Finance

Nov 27, 2024

•

5 min read

Data Reasoning: The Solution For Automating Complex Data Workflows in Financial Services

The Value of Data in Financial Services

In the financial services sector, data serves as the foundation for making informed decisions, driving efficiency, and crafting strategic opportunities. Banks, asset managers, and investment firms collect vast amounts of data, yet unlocking its true value requires more than just accumulation. Financial institutions must:

Leverage their institutional knowledge and insights that are often tucked away in unstructured data (e.g. market analysis reports, legal documents, customer communications, etc.)

Execute complex workflows that go beyond processing data to applying advanced logic and reasoning to it - enabling actionable insights and informed decision-making.

Historically, automating these high-order operations has been challenging due to the quality and precision required. For financial institutions, they often rely on manual processes, which can consume a large amount of time and resources. However by leveraging AI, financial institutions can now automate these processes at scale and unlock immense value for their business including:

Cost Optimization: Streamlining compliance tasks or automating back-office processes that traditionally require large teams to manage.

Revenue Enhancement: Maximizing the full potential of their data to deliver investment insights, improve customer experiences, and create innovative financial products.

Evolving from Basic to Higher Order Operations in Finance

While basic data operations in finance might include calculating portfolio returns or summarizing transaction histories, higher-order operations involve deeper reasoning and insight generation. This may include:

Risk Assessment: Analyzing patterns to detect fraud or evaluate credit risk.

Sentiment Analysis: Gauging market sentiment from a variety of sources (e.g. news, reports, social media, etc.) to help develop informed decisions.

Scenario Forecasting: Using historical financial data to predict future market trends or portfolio performance.

Regulatory Analysis: Parsing legal or compliance documents in real-time to ensure adherence to evolving regulations.

Entity and Relationship Recognition: Identifying connections between entities, such as financial instruments, companies, or clients, to uncover market opportunities or risks.

These are just a few advanced workflows that are critical to maintaining competitiveness in a highly regulated and fast-moving industry. However these type of workflows are often constrained by the complexity of the tasks and the need for domain expertise.

Challenges in Financial Data Workflows

Working with Complex Financial Data

Data Quality and Integrity: Financial data often contains inconsistencies, such as outdated data used for generating regulatory reports (e.g., for SEC or Basel III compliance) that can lead to penalties or reputational damage or discrepancies between systems (e.g. duplicate or mismatched customer records due to siloed systems used for credit cards, loans, and checking accounts) leading to inaccurate insights if not properly addressed.

Diverse Data Sources: To maximize ROI from their data, financial institutions often try to extract as much as possible from both structured data (e.g., market prices) and unstructured data (e.g., analyst reports) located in various systems, APIs, and external datasets. However leveraging unstructured data is both complex and time-consuming.

Domain Expertise: Financial analysis require deep knowledge of market dynamics, regulatory frameworks, and investment strategies. As a result, collaboration between domain experts and technical teams is a absolute must.

Data Integration and Interoperability: Merging datasets from disparate sources, such as banking systems, customer profiles, and regulatory archives, make it difficult for financial institutions to maintain consistency and relevance.

Performing Logical Reasoning Reliably

Causal Inference: Identifying cause-and-effect relationships in financial data is complex, especially when linking market trends, customer behaviors, or policy changes to financial outcomes. Simply identifying correlations is not enough; understanding the underlying causal mechanisms requires a sophisticated process and heavily resourced team to tackle.

Abstraction and Generalization: Generalizing insights from financial data is challenging due to variability in market conditions, customer behaviors, and regulations. Models trained on specific datasets often struggle to apply findings to new contexts, requiring designs that avoid overfitting and capture broader financial principles.

Multi-Step Reasoning: Financial processes, like assessing credit risk or managing portfolios, involve sequential steps. This is challenging to do using traditional methods as it would struggle with handling intermediate conclusions.

Handling Exceptions and Edge Cases: Finance is full of anomalies, such as market crashes or unusual customer behaviors. Traditional methods will often fail to address these outliers or overlook them, impacting the reliability from what’s generated.

These complex workflows are not only time-consuming, but they require precision to ensure reliability and confidence in the outputs. More often than not, this requires dedicated resources with the right mix of expertise to help navigate the intersection between data and logic, which can be challenging even if you're fully staffed.

Transforming Financial Operations with Data Reasoning Workflows

As financial institutions face increasing competition and regulatory scrutiny, adopting data reasoning workflows has become a necessity. These workflows enable the automation of higher-order operations, from extracting insights to making data-driven decisions. Here are some examples of how data reasoning is being used today in financial services:

Regulatory Compliance: Automating the review of contracts, filings, and regulatory frameworks to ensure adherence to global standards, reducing the risk of penalties.

Fraud Detection: Analyzing transaction patterns and behavioral data to identify suspicious activities, enabling proactive fraud prevention.

Portfolio Optimization: Synthesizing historical performance, market forecasts, and client goals to recommend optimized investment strategies.

Customer Personalization: Leveraging unstructured customer data, such as email correspondence and survey responses, to craft personalized financial products and advisory services.

Market Intelligence: Integrating structured (e.g. stock prices) and unstructured data (e.g. news feeds) to predict market trends or identify lucrative investment opportunities.

These workflows drive significant value in financial services, but their complexity often necessitates advanced tools, data expertise, and a fully staffed machine learning team. For many financial institutions, overcoming these hurdles is critical to delivering high-quality customer experiences while reducing operational inefficiencies and staying competitive in a fast-evolving market.

Introducing Gradient’s AI-Powered Data Reasoning Platform

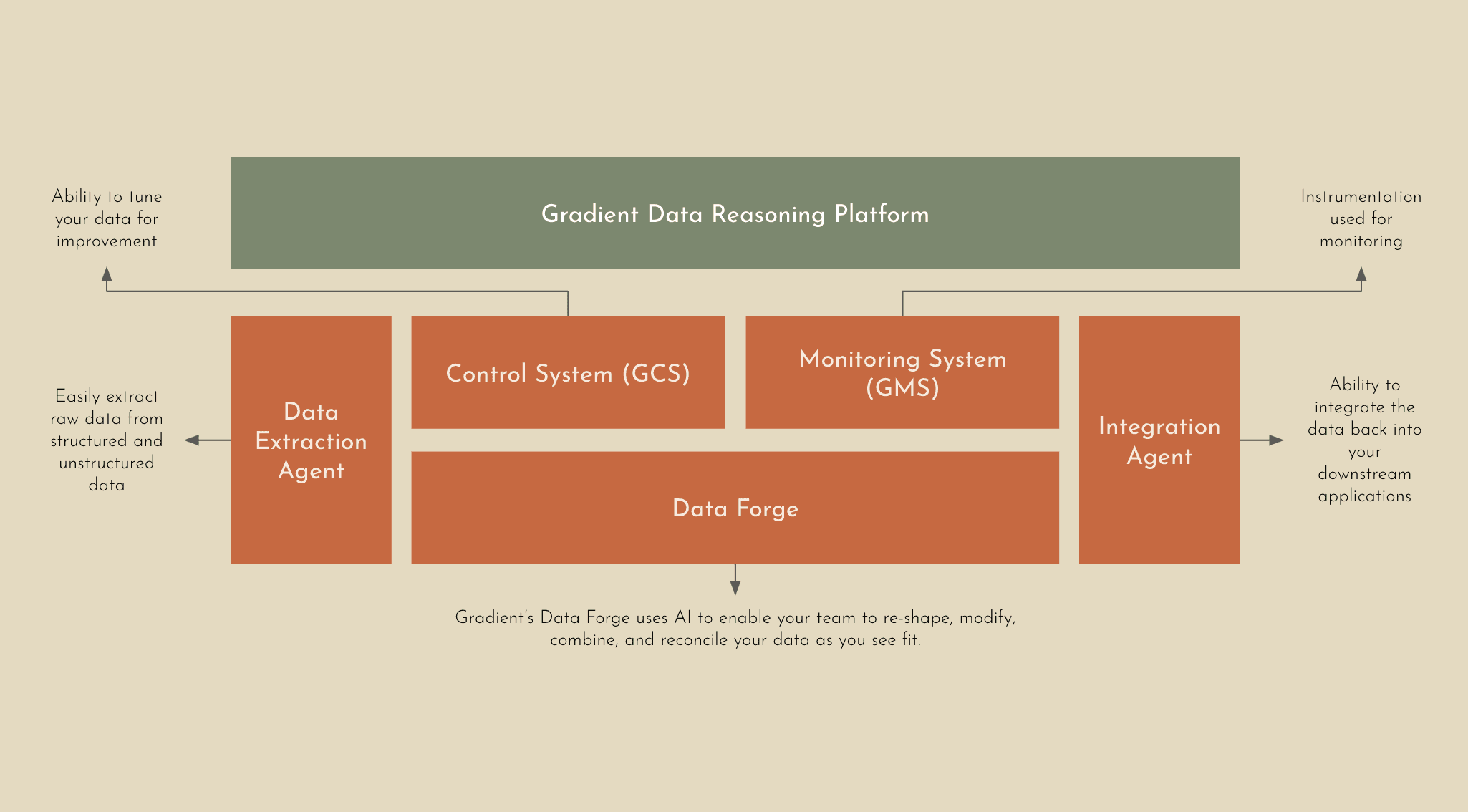

To greatly simplify this process, Gradient has developed the first AI-powered and SOC 2 Type 2 compliant Data Reasoning Platform that’s designed to automate and transform how financial services companies handle their most complex data workflows. Powered by a suite of proprietary large language models (LLMs) and AI tools, Gradient eliminates the need for manual data preparation, intermediate processing steps, or a dedicated ML team to maximize the ROI from your data. Unlike traditional data processing tools, Gradient’s Data Reasoning Platform doesn’t require teams to create complex workflows from scratch and manually tune every aspect of the pipeline.

Schemaless Experience: The Gradient Platform provides a flexible approach to data by removing traditional constraints and the need for structured input data. Enterprise finance organizations can now leverage data in different shapes, formats, and variations without the need to prepare and standardize the data beforehand.

Deeper Insights, Less Overhead: Automating complex data workflows with higher-order operations has never been easier. Gradient’s Data Reasoning Platform removes the need for dedicated ML teams, by leveraging AI to take in raw or unstructured data to intelligently infer relationships, derive new data, and handle knowledge-based operations with ease.

Continuous Learning and Accuracy: Gradient’s Platform implements a continuous learning process to improve accuracy that involves real-time human feedback through the Gradient Control System (GCS). Using GCS, enterprise businesses have the ability to provide direct feedback to help tune and align the AI system to expected outputs.

Reliability You Can Trust: Precision and reliability are fundamental for automation, especially when you’re dealing with complex data workflows. The Gradient Monitoring System (GMS) identifies anomalies that may occur to ensure workflows are consistent or corrected if needed.

Designed to Scale: Typically the more disparate data you have, the bigger the team you’ll need to process, interpret, and identify key insights that are needed to execute high level tasks. Gradient enables you to process 10x the data at 10x the speed without the need for a dedicated team or additional resourcing.

Even with limited, unstructured or incomplete datasets, the Gradient Data Reasoning Platform can intelligently infer relationships, generate derived data, and handle knowledge-based operations - making this a completely unique experience. This means that teams can automate even the most intricate workflows at the highest level of accuracy and speed - freeing up valuable time and overhead.

Under the Hood: What Makes it Possible

The magic of the Gradient Data Reasoning Platform is its high accuracy, quick time to value, and easy integration into existing enterprise systems.

Data Extraction Agent: Our Extraction Agent intelligently ingests and parses any type of data into Gradient without hassle, including raw and unstructured data. Whether you’re working with PDFs or PNGs we’ve got you covered.

Data Forge: This is the heart of the Gradient Platform. AI automatically reasons about your data - re-shaping, modifying, combining, and reconciling your structured and unstructured data via higher order operations to achieve your objective. Our Data Forge leverages advanced agentic AI techniques to guide the models through multi-hop reasoning reliably and accurately.

Integration Agent: When your data is ready, Gradient will ensure that your data can be easily integrated back into your downstream applications via a simple API.

With Gradient, businesses can focus on the outcomes—whether it’s driving customer insights, ensuring regulatory compliance, or optimizing production lines—without getting bogged down in the operational intricacies of data workflows. By automating complex data workflows, organizations can achieve faster, more accurate results at scale - reducing costs and enhancing operational efficiency. In a world where data complexity continues to grow, the ability to harness that data through automation is not just a competitive advantage—it’s a necessity.

Conclusion

With Gradient, businesses can focus on the outcomes—whether it’s driving customer insights, ensuring regulatory compliance, or optimizing production lines—without getting bogged down in the operational intricacies of data workflows. By automating complex data workflows, organizations can achieve faster, more accurate results at scale - reducing costs and enhancing operational efficiency. In a world where data complexity continues to grow, the ability to harness that data through automation is not just a competitive advantage—it’s a necessity.

Share